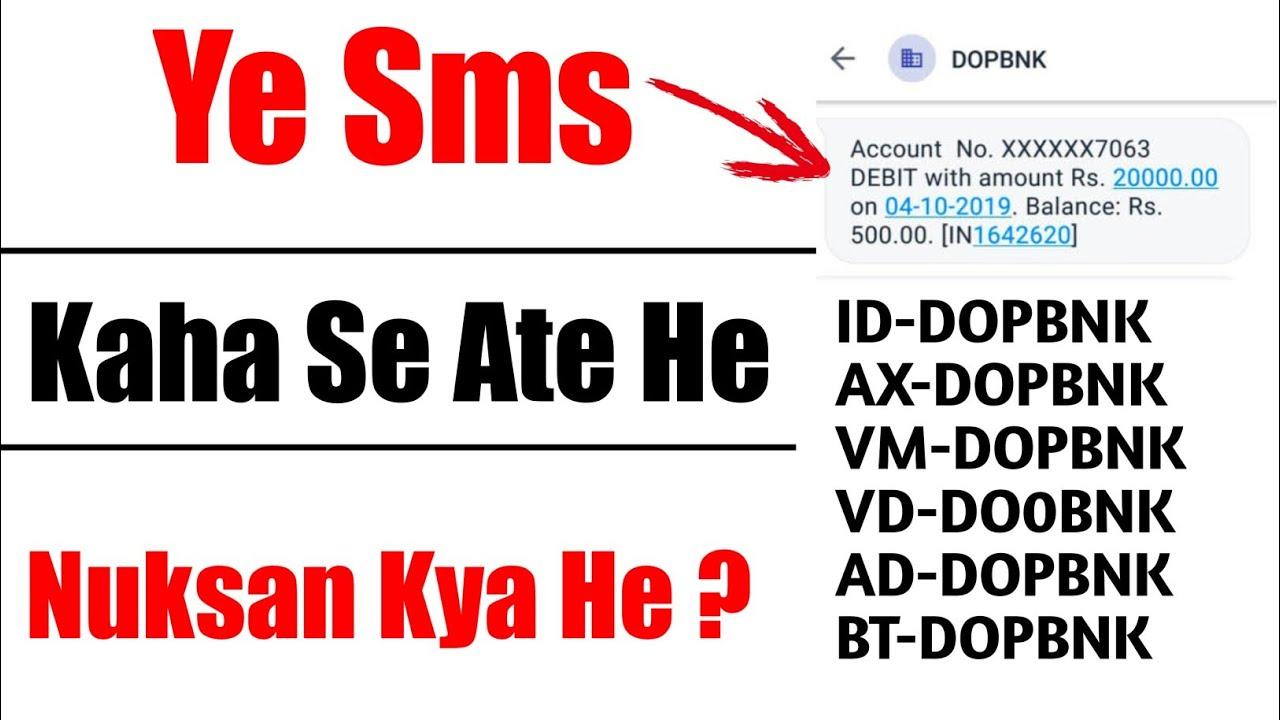

DOPBNK, short for “Department of Post Banking,” is an initiative by the Indian government to provide banking services through post offices across the country. It aims to bring banking services to the doorstep of every Indian, especially those in rural and remote areas. In this guide, we will explore the full form of DOPBNK and how it benefits both developers and users.

What is DOPBNK?

DOPBNK Full Form stands for “Department of Post Banking.” It is an initiative launched by the Indian government to leverage the vast network of post offices across the country to provide banking services to the masses. Through DOPBNK, customers can open savings accounts, deposit and withdraw money, and avail themselves of various banking services offered by traditional banks.

How DOPBNK Benefits Developers

- Increased Reach: Developers can leverage the vast network of post offices to reach a wider audience, especially in rural and remote areas where traditional banking services may not be readily available.

- Financial Inclusion: By developing applications that integrate with DOPBNK Full Form, developers can contribute to the government’s goal of financial inclusion by providing banking services to underserved communities.

- Opportunities for Innovation: DOPBNK opens up opportunities for developers to innovate and create new banking solutions that cater to the unique needs of customers accessing banking services through post offices.

Practical Tip for Developers: When developing applications that integrate with DOP BNK, ensure that your app is user-friendly and accessible to customers with limited banking knowledge. Provide clear instructions and guidance to help them navigate the app easily.

How DOPBNK Benefits Users

- Convenience: DOP BNK brings banking services closer to home, making it convenient for users to access banking services without having to travel long distances to a traditional bank branch.

- Accessibility: For users in remote areas with limited access to traditional banking services, DOPBNK provides a much-needed avenue to manage their finances and access basic banking services.

- Financial Literacy: By using DOPBNK Full Form, users can become more financially literate as they learn to manage their finances, save money, and make informed decisions about their financial future.

Practical Tip for Users: Take advantage of the banking services offered by DO PBNK to manage your finances more effectively. Use the services to save money, track your expenses, and plan for the future.

Conclusion

DOPBNK is a game-changer in the banking sector, providing access to banking services to millions of Indians who were previously underserved. For developers, it opens up new opportunities for innovation and reaching a wider audience. For users, it offers convenience, accessibility, and the chance to become more financially literate. As DOPBNK continues to expand its reach, it will play a crucial role in driving financial inclusion and empowering individuals across India.

Leave a Reply